Investing in an IRA: When, Why and How Much

Provided by Bankers Trust

Individual Retirement Arrangements, or IRAs, are common retirement plans. It’s important to know when and how much to invest in order to get the most out of your plan.

When and how much should you invest in an IRA?

Financial experts have varying viewpoints on when and how much to invest. For some, they’ll suggest early January with the belief prices are lower during the beginning of the year, providing a greater chance at investing before stock appreciation. Investing early in the year also means your contribution will have the maximum time to gain returns and grow. Therefore, investing the maximum amount, which is $6,000 (or $7,000 for individuals over 50) at the start of the year, often means you get the most out of your investment.

However, if investing $6,000 within the first few weeks of the year isn’t possible, or you’re a risk-averse client, dollar cost averaging, or DCA, allows you to make contributions throughout the year. For the budget-conscious, DCA allows individuals to plan consistent monthly contributions and increases the opportunity to invest during unexpected market declines.

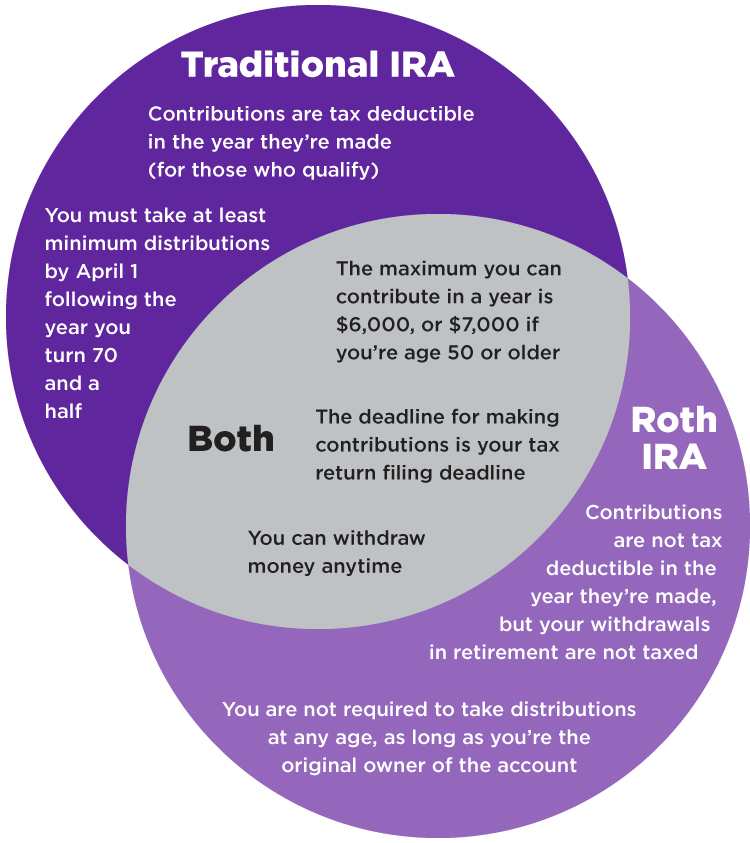

What’s the difference between a Traditional IRA and Roth IRA?

Traditional IRA

- Contributions are tax-deductible in the year they’re made (for those who qualify)

- You must take at least minimum distributions by April 1 following the year you turn 70 and a half

Both

- The maximum you can contribute in a year is $6,000 or $7,000 if you’re age 50 or older

- The deadline for making contributions is your tax return filing deadline

- You can withdraw money anytime

Roth IRA

- Contributions are not tax deductible in the year they’re made, but your withdrawals in retirement are not taxed

- You are not required to take distributions at any age, as long as you’re the original owner of the account

What are the benefits of investing in an IRA?

In addition to the tax treatments, each provides tangible benefits, such as first-time-home-buyer, qualified education, or hardship withdrawal expenses. Typically, IRAs are less restrictive than other retirement plan options, such as 401(k)s. This means you can choose from a variety of providers and investment options, whereas 401(k)s are often limited to employer-provided options. With multiple options within your IRA, it’s important to understand the basics of asset allocation in order to build a balanced investment portfolio. It’s also important to have an idea of how much income you will need in retirement and how long your retirement savings will last. Be sure to check out our retirement financial calculators for help.

View more Articles